1st International IFA Czech Branch Transfer Pricing Conference

“Transfer pricing is not an exact science but does require the exercise of judgement on the part of both the tax administration and taxpayer.”

Art. 1.13, OECD Transfer Pricing Guidelines for Multinational Enterprises and Tax Administration, ISBN 978-90-8722-430-1

Actions no. 8, 9, 10 and 13 of the BEPS deal exclusively with transfer pricing, while another 7 actions have also an impact on these issues. The existing practice indicates that company managers take tax aspects into consideration during their business decision-making process. It is a trend that always more and more firms, not only in the field of consulting, are currently trying to recruit transfer pricing experts. The OECD Transfer Pricing Guidelines for Multinational Enterprise and Tax Administrations were amended in July 2017. Experts from the International Fiscal Association (IFA), Czech Republic in cooperation with the Chamber of Tax Advisers of the Czech Republic are aware of these issues and organise a conference with a view to making its participants familiar, through renowned foreign as well as domestic lecturers giving lectures focused on business, consultancy, intergovernmental organisations, state administration and academic sphere with current topics in the following areas: transfer pricing and its impact on financial transactions from the viewpoint of bank institutions, legislative regulations concerning transfer pricing in the Czech Republic in the context of the OECD Transfer Pricing Guideline and art. 9 of the OECD Model Tax Convention, transfer pricing documentation and its extent in the context of tax administration, administrative approaches aimed at prevention and resolution of disputes in the field of transfer pricing - possibilities, practical approach and experience from assurance and elaboration of binding assessments, intellectual property and digital transformation in the context of taxable incomes generated by technological giants in the U.S.A. and approach of the OECD and EU, presentation of practical experience during the drawing up of transfer pricing documentation within the framework of multinational companies, current development in the field of transfer pricing from the viewpoint of a representative of the OECD, possibilities of extension of specialised knowledge and international certificates in the area of transfer pricing.

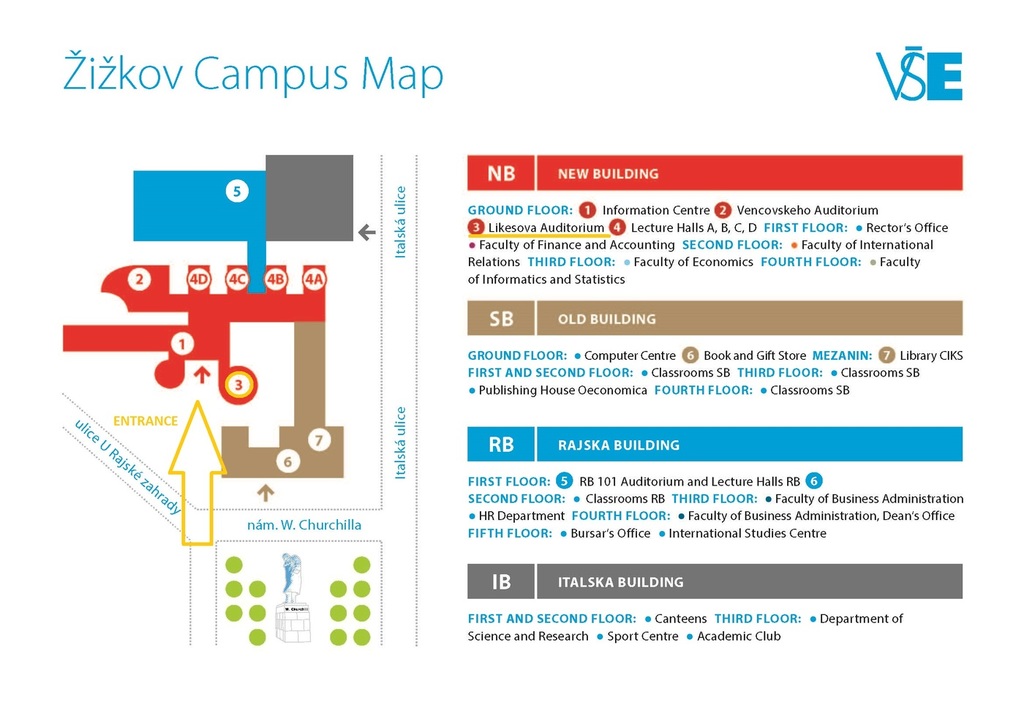

Venue: University of Economics, Prague, W. Churchill Sq. 1938/4, Prague 3.

Agenda - The conference will be translated simultaneously in English and Czech.

16 October 2018 (Tuesday) 9:00 - 17:45 hrs.

| 8:00 - 9:00 | Registration |

|

|

9:00 – 9:30 |

Opening speeches |

|

|

9:30 – 10:00 |

TP financial transactions |

|

|

10:00 – 10:30 |

Continuing losses and their relationship with pre – and post – restructuring |

|

|

10:30 – 11:00 |

|

|

|

11:00 – 11:15 |

Award presentation to the winners of the 1st year contest for diploma theses on tax-related subjects announced by the Chamber of Tax Advisors of the Czech Republic |

|

|

11:15 – 11:45 |

12 myths around transferpricing |

|

|

11:45 – 12:15 |

Digitalization of business models and TP: the new frontier of business restructurings |

|

|

12:15 – 12:45 |

TP and digital transformation |

|

|

12:45 – 13:00 |

The importance of data in the post-BEPS era |

|

|

13:00 – 14:00 |

|

|

|

14:00 – 14:30 |

Simplification vs. complexity: Is it time for safe harbours arm´s lenght range? |

|

|

14:30 – 15:00 |

Experience with bilateral APA and MAP in Slovakia |

|

|

15:00 – 15:30 |

Cost sharing/Cost contribution arrangements |

|

|

15:30 – 15:45 |

Role of royalty rates in the valuation of intangibles |

|

|

15:45 – 16:15 |

|

|

|

16:15 – 16:45 |

Shades of grey in the manufacturing continuum: Is there a cutting edge? |

|

|

16:45 – 17:15 |

TP documentation and its importance for tax control in the Czech Republic and abroad |

|

|

17:15 – 17:45 |

Practical experience of a CFO at a MNE in the field of TP |

|

|

|

Closing remarks |

|

Registration

The registration is closed.

Partners

Cooperating institutions

Partners

Contact

Marcela Vaňatková

E-mail: vanatkova@kdpcr.cz

Tel.: +420 542 422 329

Vít Šelešovský

E-mail: selesovsky@kdpcr.cz

Tel.: +420 542 422 317